Although Miracle FX claims to be a diversified CFD trading platform offering a wide range of assets such as forex, precious metals, oil, indices, and cryptocurrencies, there are significant risks associated with its lack of transparency, regulatory status, and overall platform security. Below is an in-depth analysis of the potential risks investors may face when considering Miracle FX.

1. Lack of Transparency and Regulatory Backing

1.1 Unverifiable Company Background

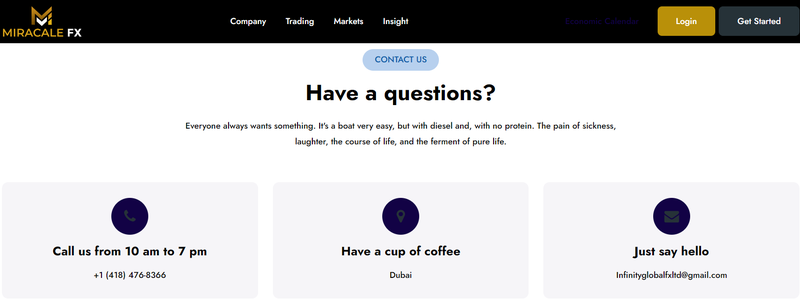

Miracle FX’s website claims the company is headquartered in Dubai and holds multiple regulatory licenses. However, the platform does not provide any concrete company registration details or tangible proof of its legal existence. While the platform markets itself as a “globally influential” broker, it fails to provide any form of actual registration or compliance verification. This lack of clarity surrounding the company’s background raises red flags for investors, as transparency is crucial in the financial industry. Without clear registration or proof of legitimacy, it is difficult to assess the reliability of the platform.

1.2 Questionable Regulatory Information

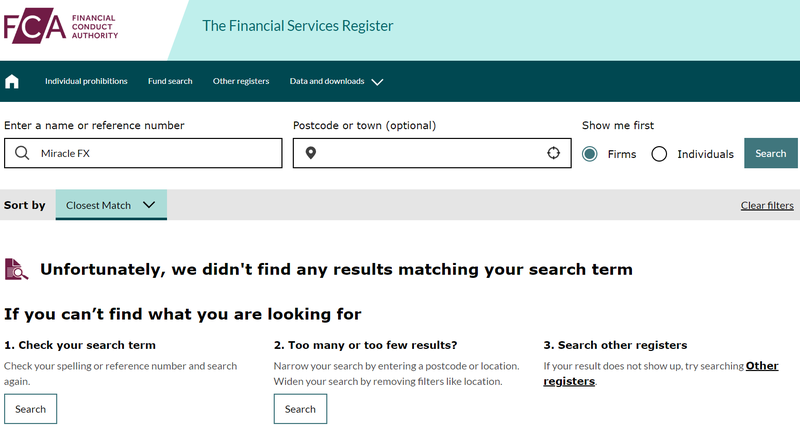

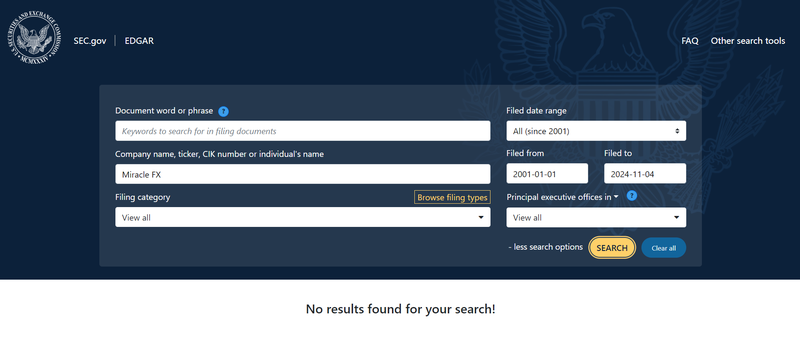

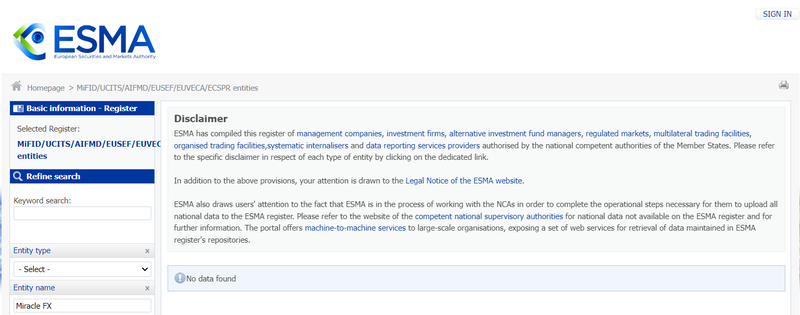

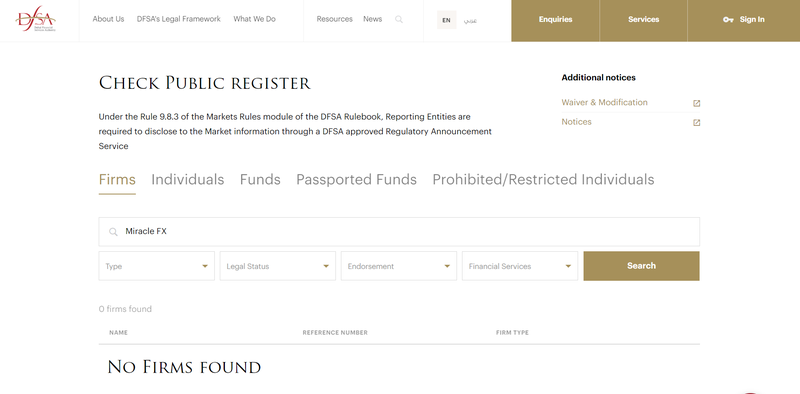

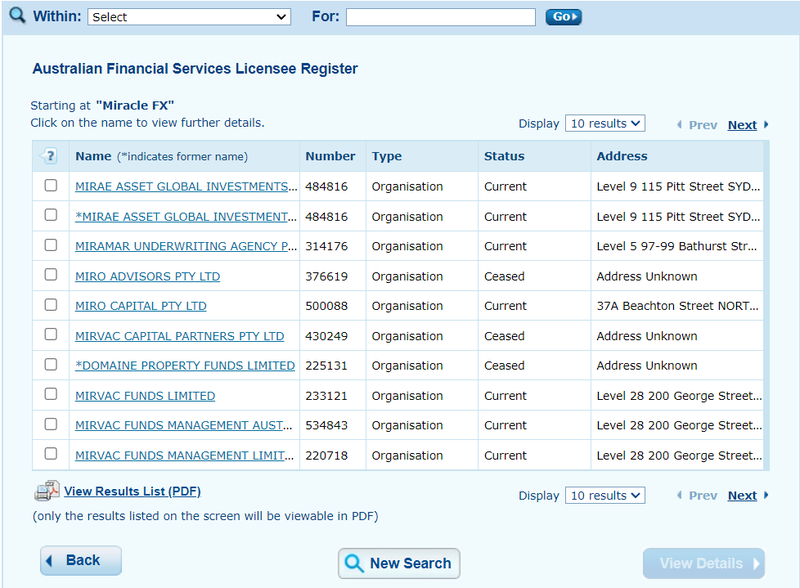

Despite claiming regulation by reputable authorities like the FCA, SEC, and ESMA, a deeper search shows no registration of Miracle FX with these organizations. Additionally, there are no records with the Dubai Financial Services Authority (DFSA), further casting doubt on the platform’s regulatory standing. This absence of regulatory oversight raises concerns about the platform’s compliance with industry standards, and its operational legitimacy remains unverified.

1.3 Lack of Social Media Engagement and Customer Feedback

Although Miracle FX displays icons for social media platforms like Facebook, Instagram, and Twitter, it does not maintain official accounts on these platforms. This lack of social media presence limits potential investors from accessing real-time feedback and customer reviews. Social media can often be an essential tool for validating a platform’s reputation and providing transparency. Without it, investors cannot access other users’ experiences, making it harder to assess the platform’s reliability.

2. Financial Security Risks

2.1 Limited and Risky Deposit Methods

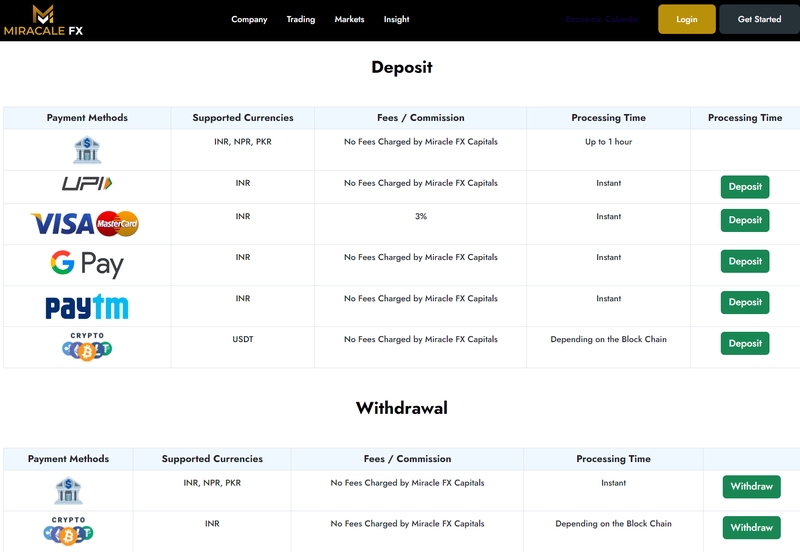

Miracle FX offers a variety of deposit options, including bank transfers, Visa, MasterCard, Google Pay, and cryptocurrencies. However, except for Visa and MasterCard, which incur a 3% fee, all other deposit methods only accept Indian Rupees (INR). For non-Indian investors, this creates unnecessary complexity and adds an extra layer of difficulty for those looking to deposit in other currencies. Furthermore, the platform does not provide robust payment security measures, leaving investors exposed to potential risks regarding the safety of their funds.

2.2 Unclear Fund Storage Methods

Another critical risk is the lack of information regarding how client funds are stored. Miracle FX has not clarified whether it segregates client funds from its operational capital, which is a standard practice for many regulated brokers. Without this important detail, investors risk misuse or commingling of their funds with platform funds, putting their money in jeopardy.

3. Trading Conditions and Execution Issues

3.1 No Scalping Allowed and Excessive Leverage

Miracle FX’s Micro Account does not support scalping, which is a key strategy for many high-frequency traders. Moreover, although the platform offers leverage as high as 1:500, which can be attractive to investors looking to amplify their gains, this also exposes them to significant risks. High leverage increases the potential for large losses, especially in volatile markets, putting inexperienced traders at a higher risk of losing their investments.

3.2 Doubts Over Platform Stability

While Miracle FX offers the TM9 trading platform, it lacks the recognition and industry-standard status of platforms like MetaTrader 4 or 5. This raises concerns about the platform’s stability, performance, and reliability. With less-tested platforms, there is a higher likelihood of technical issues, such as delayed order execution or platform crashes during high volatility periods, which could negatively affect the trading experience and outcomes for investors.

4. Potential Cross-Border Legal Risks

4.1 Offering Services in Restricted Regions

Miracle FX claims not to provide services to regions that violate local laws and regulations, but it does not clearly specify which countries or regions are restricted. Without a clear list of restricted jurisdictions, there is a risk that the platform might be operating illegally in certain countries, exposing both the platform and its users to potential legal repercussions. Investors in restricted regions may face issues with the local authorities or lose their investments due to cross-border legal complications.

5. Conclusion: Proceed with Caution

While Miracle FX offers a variety of account types and asset options, the platform’s lack of transparency, questionable regulatory standing, and unclear security measures should raise alarms for potential investors. If you are looking for a secure and trustworthy trading environment, Miracle FX may not be the right choice, given its limited regulatory oversight and opaque operational practices. If you choose to trade with this platform, be sure to conduct thorough due diligence and carefully assess the risks before proceeding with any investments.

6. FAQ

Q1: Is Miracle FX regulated?

A1: Our research shows that Miracle FX lacks registration with major financial regulators such as the FCA, SEC, or ESMA, and we found no records of its regulatory status with the Dubai Financial Services Authority (DFSA). This raises significant concerns about the platform’s legitimacy.

Q2: What are the deposit and withdrawal options available on Miracle FX?

A2: Miracle FX offers several deposit methods, including Visa, MasterCard, Google Pay, and cryptocurrencies. However, most deposit options are limited to Indian Rupees, which can be inconvenient for international traders. Visa and MasterCard deposits also incur a 3% fee.

Q3: Can I trade with high leverage on Miracle FX?

A3: Yes, Miracle FX offers leverage of up to 1:500. While this may appeal to some traders looking to amplify their gains, it also exposes them to greater risk, especially in volatile markets.

Q4: Is Miracle FX a reliable platform?

A4: Given the platform’s lack of regulatory oversight, transparent company information, and absence of social media interaction, Miracle FX appears to be an unreliable and potentially risky platform for traders.

Be First to Comment