The foreign exchange and CFD (Contract for Difference) markets are constantly expanding, drawing countless investors worldwide. With this growth, numerous platforms have emerged. Some platforms use false information to mislead investors, often fabricating regulatory claims or company entities to trick investors into depositing funds. CKRTY is a newly established forex broker that claims to offer a wide range of financial products. However, an in-depth investigation reveals obvious falsifications in its registration and regulatory information, exposing potential investment risks. This article will provide a detailed analysis of CKRTY’s corporate background, domain registration, fake regulatory information, and possible risks to help investors understand these investment dangers.

I. Corporate Background: CKRTY’s Basic Information

CKRTY is a forex broker registered on March 25, 2024. It claims to offer users access to various markets, including forex, metals, commodities, and indices, through its self-developed trading platform. The platform states that it does not provide services in the United States, Iran, North Korea, and other regions, attempting to present an image of global regulatory compliance.

1.1 Proprietary Trading Platform and Financial Products

CKRTY highlights that it provides forex and CFD trading services to global users through a proprietary platform, unlike other brokers that use mainstream trading platforms (such as MT4, MT5). While proprietary platforms can offer tailored services, they usually lack market validation, which presents potential technical risks for investors.

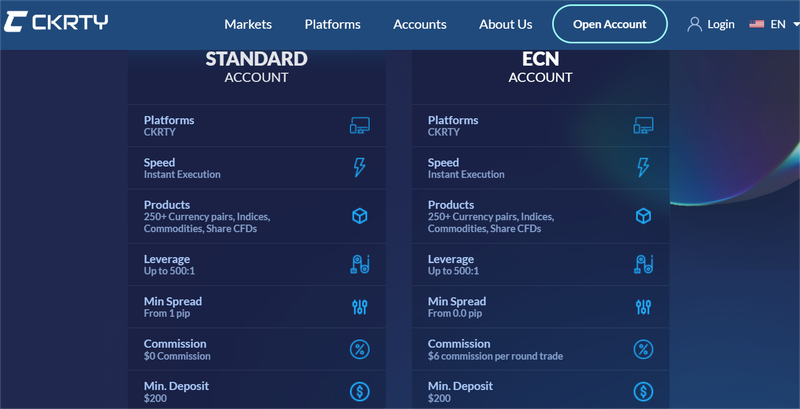

CKRTY claims to offer forex, metals, commodities, and indices. It provides two account types: the STANDARD ACCOUNT and the ECN ACCOUNT. Both accounts offer leverage up to 1:500, with a minimum deposit of $200, differing in spreads and commissions. Although these conditions may seem enticing, investors should approach them cautiously, especially given concerns over the platform’s regulatory compliance.

CKRTY offers multiple financial products and high-leverage accounts. However, as its proprietary trading system has not been widely validated in the market, it could carry technical risks, especially with questions about its regulatory status.

II. Domain Information: Risks of Short-Term Registration

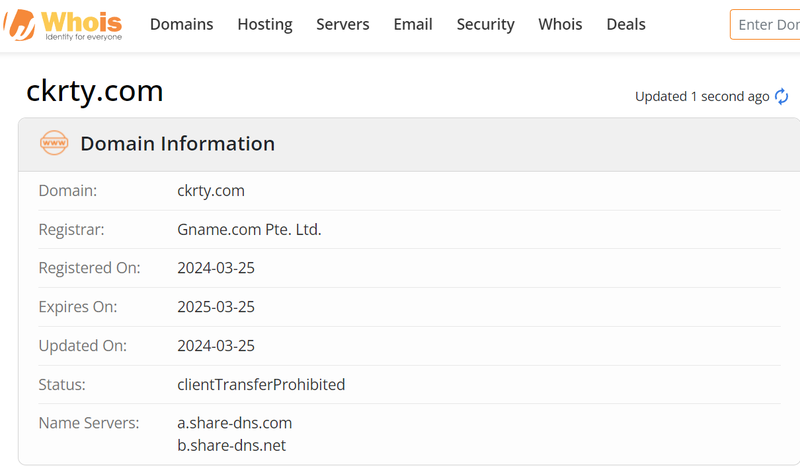

An analysis of domain registration data can reveal information about a platform’s history and reliability. CKRTY’s domain was registered on March 25, 2024, making it a newly established trading platform.

2.1 Risks of Short-Term Domain Registration

CKRTY’s domain was registered only a few months ago. Success in forex and CFD trading often relies on a platform’s long-term reputation and stable operations, and CKRTY’s brief registration means investors cannot rely on its track record to assess its security. Short-term domain registrations are often associated with high-risk platforms, which tend to attract investors quickly, accumulate funds, and then shut down, leaving investors unable to retrieve their funds.

2.2 Lack of Transparency in Domain Information

Legitimate financial platforms typically disclose domain-related information on their websites, such as the operating team, technical support, and relevant legal assurances. However, CKRTY does not provide any specific information on the entity behind its domain registration. This lack of transparency further heightens investor concerns, especially when the platform’s history and background are difficult to trace. Investors should be highly cautious about its safety and legitimacy.

CKRTY’s short domain registration period and lack of transparent operational information indicate potential financial risks and operational instability.

III. Falsified Registration Entity: Questionable Legal Identity of CKRTY

CKRTY claims to be registered as CKRTY Limited and regulated by several regulatory agencies. However, further investigation shows that its registration information is largely falsified, with attempts to misappropriate the legal registration information of other companies.

3.1 Fake Registration in Australia and Vanuatu

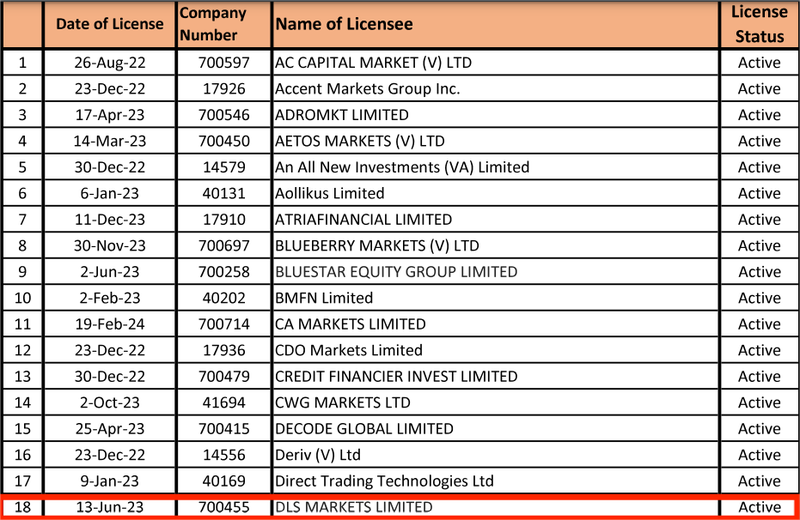

CKRTY claims to be registered in Australia and regulated by the Australian Securities and Investments Commission (ASIC) with license number 296805. However, ASIC’s official records show that license number 296805 corresponds to DLS MARKETS (AUST) PTY LTD, not CKRTY. Additionally, CKRTY claims to be regulated by the Vanuatu Financial Services Commission (VFSC) under license number 700455, but this license actually belongs to DLS MARKETS LIMITED, not CKRTY.

This practice of misappropriating other companies’ registration information is common among fraudulent financial platforms, which aim to build investor trust through fake credentials to attract funds.

3.2 Falsified Financial Commission Membership

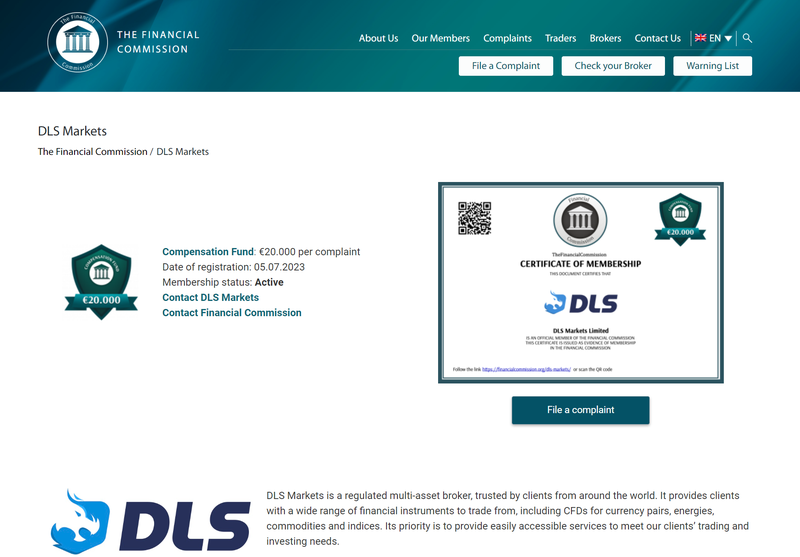

CKRTY claims to be a registered member of The Financial Commission. However, a review of the Financial Commission’s official member list shows no mention of CKRTY. Instead, only DLS MARKETS is listed as a member. Clearly, CKRTY is trying to mislead investors by misappropriating DLS MARKETS’ information to suggest legitimate financial oversight.

CKRTY’s registration information is falsified, misappropriating the legitimate details of other companies and falsely claiming regulation by multiple agencies, indicating clear deception and untrustworthiness.

IV. Fabricated Regulatory Claims: CKRTY is Not Under Any Reputable Regulation

Whether a financial platform is supervised by a legitimate regulatory body is crucial for investors assessing the security of their funds. CKRTY claims to be regulated by the Australian Securities and Investments Commission (ASIC) and the Vanuatu Financial Services Commission (VFSC); however, these claims are false.

4.1 Fake ASIC Regulation Claim in Australia

CKRTY claims to be regulated by ASIC under license number 296805. However, ASIC’s official website confirms that license number 296805 is registered to DLS MARKETS (AUST) PTY LTD, not CKRTY. This means CKRTY is not regulated by the Australian Securities and Investments Commission, and its regulatory claims are entirely fabricated.

4.2 Misappropriated Vanuatu Regulatory Information

CKRTY also claims that it is licensed under Vanuatu’s VFSC with license number 700455. However, license 700455 actually belongs to DLS MARKETS LIMITED, and CKRTY is not legally registered or regulated in Vanuatu. The VFSC has no record of CKRTY in its official listings.

4.3 Fake Membership with the International Financial Commission

CKRTY also claims to be a member of the Financial Commission. The Financial Commission’s official records show that DLS MARKETS is the legitimate member, while CKRTY is not listed. This confirms that CKRTY is a cloned site fabricating multiple registration and regulatory details to deceive investors.

CKRTY is not regulated by any credible authorities, and all regulatory claims are fabricated. Without regulation, investor funds have no legal protections on this platform.

V. Excessive Trading Leverage: Potential Financial Risks

CKRTY offers users leverage of up to 1:500. Although high leverage can amplify profits, it also amplifies risk, especially in volatile markets, where investors may lose all their funds in a short time.

5.1 High Leverage and Market Volatility Risk

High leverage may attract many investors hoping to trade large positions with small amounts of capital, but in reality, excessive leverage means investors must endure greater market volatility risk. In highly volatile markets, investor accounts are vulnerable to forced liquidations, leading to complete capital losses. Regulated financial platforms usually restrict leverage to protect investors from excessive risk. CKRTY’s leverage of 1:500 far exceeds the limits of most regulatory authorities, showing its lack of concern for investor security.

5.2 Compliance Issues with High Leverage Platforms

High leverage is commonly associated with unregulated platforms. Regulated brokers are required to follow strict leverage limits to ensure investors are not exposed to severe financial losses due to high leverage. However, unregulated platforms often attract investors by offering extremely high leverage, which may seem promising in the short term but results in losses for most investors due to market fluctuations.

CKRTY’s 1:500 leverage may seem attractive, but it is extremely risky. Without regulatory oversight, investors face a high risk of forced liquidations.

VI. Minimum Deposit Issues: Hidden Traps for Investors

CKRTY’s minimum deposit requirement is $200. While this threshold may appear low and attractive for new investors, it hides potential financial traps.

6.1 The Temptation of Low Thresholds and High Risks

A low minimum deposit is often a common tactic for unregulated platforms to attract large numbers of new investors. By setting a low deposit threshold, platforms can quickly attract investors. However, once investors start depositing larger amounts, it becomes difficult for them to exit. For inexperienced investors, a low entry point can often obscure the high-risk nature of the platform.

6.2 Lack of Security for Funds

While CKRTY’s minimum deposit may be low, the platform is unregulated, leaving investor funds without legal protection. Regardless of the deposit size, if the platform seizes funds or restricts withdrawals, investors will find it difficult to recover their losses.

CKRTY’s low deposit threshold may appear attractive, but the platform’s regulatory and security issues pose high risks for investors, especially if more funds are later deposited.

VII. Conclusion: CKRTY’s Investment Risks Revealed

A detailed analysis of CKRTY’s corporate background, domain information, fake registration, fabricated regulatory claims, trading leverage, and deposit requirements reveals that this platform has serious compliance and financial security issues. CKRTY falsifies registration information, misappropriates other companies’ legitimate identities, and claims regulation by multiple agencies—all of which are false. CKRTY uses false information to attract investors, while in reality, it is a high-risk unregulated platform.

Investors should avoid platforms like CKRTY, which lack transparency and regulation, especially when fund security is not guaranteed. Instead, choose platforms regulated by reputable financial agencies that offer transparent trading conditions to ensure fund safety.

Frequently Asked Questions (FAQ)

- Is CKRTY regulated?

CKRTY claims regulation by ASIC and the VFSC, but these claims are false. The platform is not regulated by any reputable authority. - When was CKRTY’s domain registered?

CKRTY’s domain was registered on March 25, 2024. Its short operating history has not been verified by the market. - What trading products does CKRTY offer?

CKRTY claims to offer forex, metals, commodities, and indices, but significant questions exist regarding its specific trading conditions and compliance. - Is CKRTY’s leverage reasonable?

CKRTY offers leverage of 1:500, which is very high and exceeds the limits of most regulatory authorities, posing high risks for investors. - What is the minimum deposit requirement for CKRTY?

CKRTY’s minimum deposit is $200, but investors should beware of the high risks and lack of fund security. - How can I assess if a trading platform is legitimate?

Investors should check the platform’s registration and regulatory status, ensuring it is supervised by reputable financial regulators (e.g., FCA, CFTC, ASIC) to safeguard funds.

Be First to Comment